Florida Hurricane Insurance Lawyer

Home / Practice Areas / Insurance Law / Hurricane Insurance

Florida Hurricane Insurance Lawyer

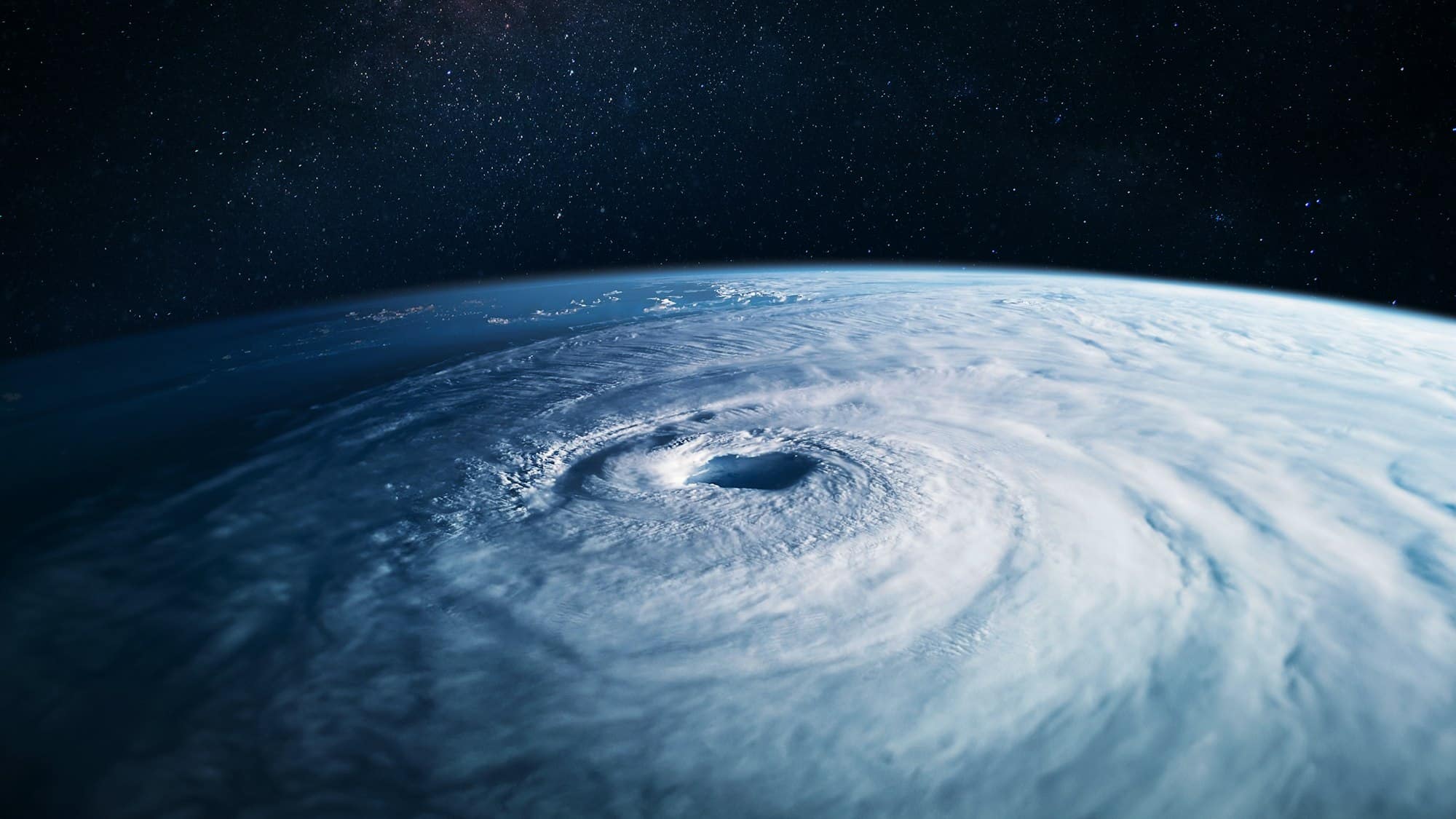

Hurricanes, tropical storms, flooding, and destructive high winds are unfortunately part of life in Florida. With recent law changes, insurance companies have been emboldened in their ability to deny or severely undervalue claims. We know hurricanes and tropical storms cause intense structural damage to your home and/or business. Navigating the claims process with your insurance company often feels like jumping through additional hoops after your property has been damaged or destroyed. We are here to help at the time of your loss. You’ve paid your policy premiums on time and you deserve coverage. You deserve to have a home and/or business repaired, livable, and free of leaks. Contact us for help making your claim or dealing with your denied or undervalued claim.

Common Challenges With Hurricane Insurance Claims

Hurricane insurance claims often come with a variety of obstacles. Policyholders may face denied or delayed claims, high deductibles, low settlement offers or disputes over coverage specifics, all of which can severely impact recovery efforts.

Denied or delayed claims

Many policyholders find that insurance companies initially deny their hurricane claims. Some insurers may argue that damage resulted from pre-existing conditions or causes not covered in the policy, such as lack of maintenance.

Delayed claims

Once your claim is made, according to Florida law, your insurer has 14 days to respond to your claim, and 90 days to deny, partially pay, or fully pay the claim.

Low settlements

Even when claims are accepted, insurance providers may attempt to settle for an amount far lower than the actual cost of repairs or argue that certain repairs are unnecessary.

Wind damage versus flood damage

A frequent dispute occurs over wind damage versus flooding. While many policies cover wind damage, flood damage often requires a separate flood policy, leaving some property owners facing coverage gaps.

Underpayment of claims

Hurricane claims often come with a large deductible, which you must pay to your insurer before they fix your property. Insurers will often adjust your claim such that the value is below that deductible so they are not responsible for the claim. According to CBS’s 60 Minutes, during Hurricane Ian, one Florida insurer would hire an “independent adjuster” and then devalue that adjuster’s claim by up to 90 percent. If you have reason to believe that your insurer has undervalued the amount of your claim, give us a call.

Schedule a Consultation

If you’re struggling with a hurricane insurance claim, you don’t have to go it alone. Let our experienced hurricane insurance lawyers at Joshua Smith, P.A., guide you through the claims process and help you recover the compensation you deserve. Contact us today to schedule a consultation and take the first step toward a fair payout that gets you started on the road to recovery.

How an Insurance Lawyer Can Help

Navigating insurance claims after a natural disaster can be overwhelming, especially when facing an uncooperative insurance company. This is where a hurricane insurance lawyer can make a significant difference.

Policy interpretation

Insurance policies are written in complex legal language that can be challenging to understand. Lawyers interpret the nuances of your policy to clarify what coverage is available.

Negotiation expertise

Insurance companies may present low offers or refuse to pay altogether. Attorneys can work to secure a fair settlement that reflects the actual cost of your hurricane damage.

Appeals process

If your claim has been denied, a lawyer can help you appeal the decision, presenting evidence and making a case to the insurance company that a payout is justified.

Legal representation

When negotiations stall, taking legal action may be necessary. An insurance lawyer can file a lawsuit on your behalf and represent you in court to seek the compensation you’re owed.

The Process

Hurricane insurance claims often come with a variety of obstacles. Policyholders may face denied or delayed claims, high deductibles, low settlement offers or disputes over coverage specifics, all of which can severely impact recovery efforts.

Making your claim

If you need assistance making your claim, contact us. If you have already made your claim and are unsatisfied with the response, contact us.

Initial consultation

Start with a consultation to review your claim, discuss the damage and assess any initial claim denials or delays.

Evidence gathering and policy analysis

The team gathers relevant evidence, including photos, damage estimates, and contractor assessments.

Negotiating with the insurance company

Hurricane claim attorneys negotiate directly with the insurance company, advocate for the maximum payout and fight below market value settlement offers.

Filing a lawsuit if negotiations fail

If the insurer remains unwilling to negotiate fairly, be prepared to take your case to court. Your legal team will represent your interests in the proceedings to secure a fair outcome.

FAQs

How Long Do I Have to File a Hurricane Insurance Claim?

The timeframe to file a hurricane insurance claim varies by policy and state regulations, but generally, it’s advisable to file as soon as possible after the damage occurs. Consult with an attorney to understand the specific deadline for your policy.

What Should I Do if My Claim Was Denied?

If your claim is denied, you can file an appeal. A hurricane damage claims attorney can help assess why the claim was denied, gather supporting evidence, and negotiate with your insurance company.

What if My Policy Doesn't Cover Flood Damage?

You may still have options if your policy doesn’t cover flood damage. A lawyer can review your policy details to determine if any exceptions or other claims may apply.

What if My Flood Insurance Policy Coverage is Too Low or Undervalued?

Your insurance broker has an obligation to ensure that your flood policy properly covers the value of your home. If you make a flood claim and are told that your property was underinsured, or that the amount of your coverage is less than the value needed to make proper repairs, contact us.